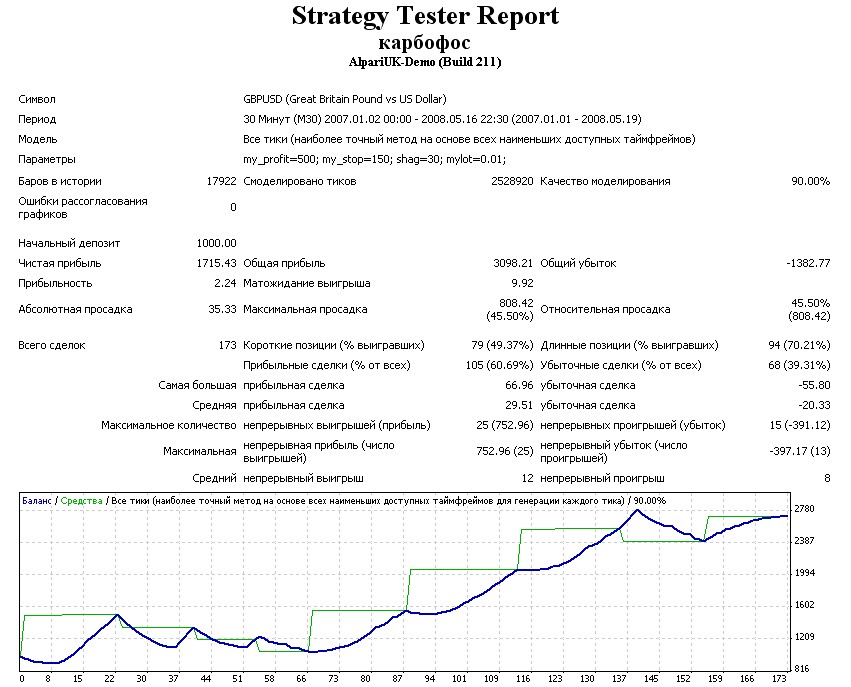

The gist of the EA is the 15 pending BuyLimit and 15 pending SellLimit

orders (the distance is specified by the "shag" value) are placed, then

some of them trigger and we wait while the price goes to the opposite

direction by the specified value - my_profit. If the price doesn't

return to the necessary side, then the loss is fixed - my_stop.

The problem is to search the necessary algorithm of floating

StopLoss specifying or the level of orders placing. I've tested it only

with the pound, but I think that it will work with the others (with the

other parameters). If anybody has any suggestions I will appreciate for

the help.

The picture:

Optimization with the stop.

Optimization without stops (shows a good result, but discharge occurs one "fine" day).

|